Instead, credit was extended to the customer and the business expects to receive payment(s) for the transaction at some point in the future. You can make things easy by providing multiple payment options, such as credit cards and ACH payments. Flexibility increases the likelihood of receiving timely payments but also enhances customer satisfaction. Note that regular reconciliation of payments with outstanding invoices can help identify any discrepancies or overdue accounts. To do this, you need accounts receivables management, popularly known as a credit management system in place.

Decide Credit Policy

You’d have $1,000 in accounts payable on your balance sheet for the invoice. Meanwhile, the supplier would have $1,000 in accounts receivable on their balance sheet. Company B now owes Company A money, so it lists the invoice in its accounts payable overhead expenses column. While Company A waits to receive the money, it records the amount in its accounts receivable column. When a company owes debts to its suppliers or other parties, those are accounts payable.

India’s choice for business brilliance

- Receivable management helps increase sales resulting in increased profitability.

- Use a documented process to monitor accounts receivable, and to increase cash collections, so you can operate your business with confidence.

- Accounts receivable is money that a company is owed by its customers.

Accounts receivable are an important element in fundamental analysis, a common method investors use to determine the value of a company and its securities. Because accounts receivable is a current asset, it contributes to a company’s liquidity or ability to cover short-term obligations without additional cash flows. how to write an invoice Accounts receivable, or receivables, can be considered a line of credit extended by a company and normally have terms that require payments be made within a certain period of time. Depending on the agreement between company and client, the payment might be due in anywhere from a few days to 30 days, 60 days, 90 days, or, in some cases, up to a year. At some point along the way, interest on the debt might also begin to accrue.

Part 2: Your Current Nest Egg

The definition of receivable management is the management of accounts not only for receivables but also for the entire process of defining credit policy and deciding payment terms. Receivable management business ensures that a sufficient amount of cash is always maintained within the business so that operations can continue uninterrupted. In addition to preparing aging schedules, financial managers also use financial ratios to monitor receivables. The accounts receivable turnover ratio determines how many times (i.e., how often) accounts receivable are collected during an operating period and converted to cash. A higher number of times indicates that receivables are collected quickly. In contrast, a lower accounts receivable turnover indicates that receivables are collected at a slower rate, taking more days to collect from a customer.

Receivable management is a process of managing the account receivables within a business organisation. Account receivables simply mean credit extended by the company to its customers and are treated as liquid assets. It involves taking decisions regarding the investment to be made in trade debtors by organisation. Deciding the proper amount be lent by the company to its customers in the form of credit sales is quite important. It affects the overall cash availability for undertaking various operations.

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on what is days sales outstanding dso objective analysis, and the opinions are our own. To help financial statement users make other decisions, GAAP call for other disclosures regarding receivables. To assist the assessment of solvency, accountants categorize receivables based on when they are due. When receivables are discounted with recourse, the issue arises as to whether the transfer should be treated as a sale or as collateral for a loan. Most of them, however, can be classified as either accounts or notes.

In any event, any contingent liability arising from discounted notes treated as sales should be disclosed in the notes to the financial statements. J. C. Penney’s annual report provides a good example of how receivables are presented in corporate financial statements. The risk can be tolerated if it produces income through finance charges or through increased sales. We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

Create a formal, written policy for collections, and enforce the policy. Company bookkeeping may require your firm to post dozens of receivable transactions each week. Other categories of non-trade receivables are disclosed separately if there is significant information conveyed to the reader by doing so.

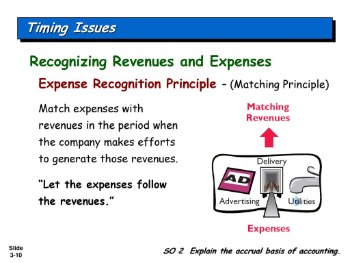

All credit comes with some degree of risk, so an important part of AR management is having a well-developed set of credit policies in place. Accounts receivable and bills receivable will show you which accounts owe you money and which bills are due. TallyPrime is a complete business management software to manage your business easily, faster, and efficiently. The accrual basis posts revenue when it’s earned, and expenses are posted when they’re incurred.